The due date to submit your Form 7004 for your extension application is on or before the due date of your tax return. So, you should pay your taxes with your extension to avoid late fees. You will be charged IRS penalties and interest charges if you pay your taxes after the original due date. If you owe taxes for the year, you are still expected to pay by the original due dates - often those due dates are either March 15 or April 15 (depending on your type of business). Tax extensions do not give you more time to pay your taxes – it only gives you more time to file your tax return. While business extensions are considered automatic, if you make mistake on your Form 7004 your tax extension will be denied.

Here are some tips for filing your business tax extension correctly: If an extension is needed, a personal tax extension can be requested with IRS Form 4868. A sole proprietor doesn’t file a business tax return - all information is reported on their personal tax return. Most companies should use Form 7004 to apply for an extension.

You don’t need to even sign FORM 7004 or provide a reason to why you need time, as business extensions are automatic. If your business needs more time to properly prepare their taxes, they can request an extension with IRS Form 7004 (Application for Automatic Extension of Time to File Certain Business Income Tax, Information, and Other Returns). So, if a business obtains a six-month extension and its original filing deadline was March 15, the new due date will be September 15. Keep in mind that the due dates for business tax extensions are often different than those for personal tax extensions.ĭepending on the type of business you run, the IRS will allow for five- or six-month extension period, starting from the original due date on the tax return. This will give your business more time to file their tax returns. Luckily, the IRS allows for both individual and business tax extension. You'll also need to enter a tentative total tax (estimated tax liability), your total payments, and your remaining estimated balance due.įor more details and other extension forms that may apply to your situation, see the IRS website.Filing taxes for your business can be overwhelming and you might need a bit more time.

#EXTENSION FOR BUSINESS TAX RETURN CODE#

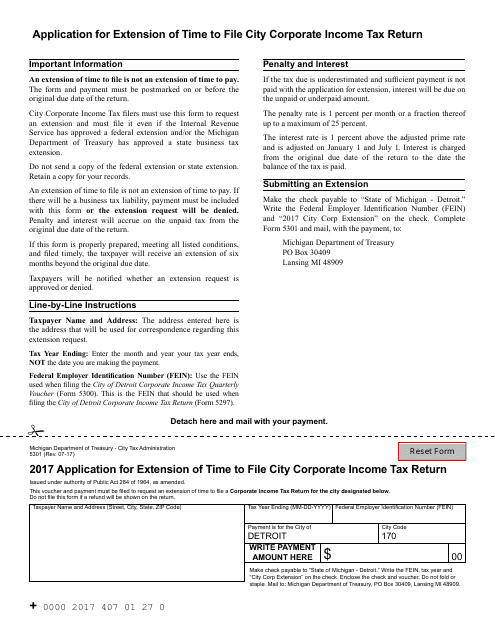

This form requires you to select a code for the type of tax return your business files. If you need to file a tax extension for your business, file Form 7004. If you don’t pay the amount due by the original due date, you’ll owe interest, and you may also incur penalties. Important: Even if you file for an extension, the due date for paying your taxes remains the same. These filing deadlines also determine when the six-month extension of time to file ends (September 15 or October 15).

#EXTENSION FOR BUSINESS TAX RETURN HOW TO#

Learn how to file for an extension of time to complete your federal tax return.Ĭan you complete your tax return before the filing deadline? If you can’t, you’re not alone.

0 kommentar(er)

0 kommentar(er)